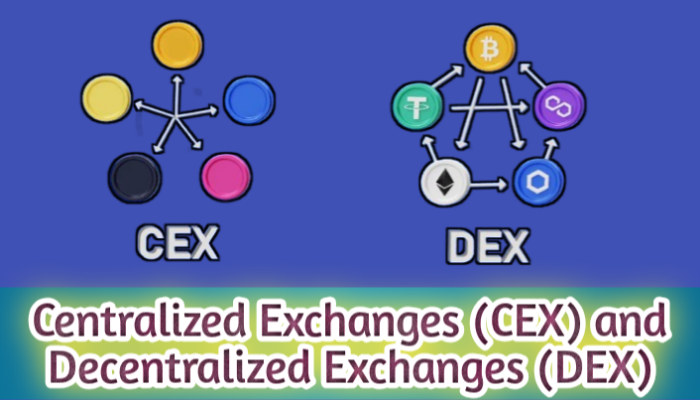

Centralized Exchanges and Decentralized Exchanges two main types of platforms dominate the market: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Both allow users to buy, sell, and trade digital assets like Bitcoin, Ethereum, and thousands of altcoins. However, they operate under very different systems.Understanding the difference between CEX and DEX is essential for anyone entering the crypto world whether you’re a trader, investor, or blockchain enthusiast.

1. What Is a Centralized Exchange (CEX)?

A Centralized Exchange is a cryptocurrency trading platform that operates under the control of a central organization or company.

It acts as a middleman between buyers and sellers, facilitating transactions while maintaining control over user accounts, order books, and funds.

1.1 How a CEX Works

When you create an account on a centralized exchange (like Binance or Coinbase):

- You deposit funds (either fiat currency like USD or crypto like Bitcoin).

- The exchange holds your funds in its custodial wallets.

- You place orders to buy or sell crypto.

- The exchange’s internal system matches buy and sell orders automatically.

Essentially, you trust the exchange to manage your money and execute your trades securely.

1.2 Examples of Popular Centralized Exchanges

- Binance – The world’s largest exchange by trading volume.

- Coinbase – One of the most trusted and beginner-friendly CEX platforms.

- Kraken – Known for its security and advanced trading features.

- KuCoin – Offers a wide range of altcoins and staking options.

- Bybit and OKX – Popular for futures and derivatives trading.

2. Advantages of Centralized Exchanges

Centralized exchanges dominate the market because they offer several user-friendly and efficient features.

2.1 High Liquidity

CEX platforms usually have millions of users, leading to high trading volumes.

This means trades are executed faster, and there’s less price slippage.

2.2 User-Friendly Interface

Most CEX platforms have intuitive dashboards and apps that make trading easier even for beginners.

They often include charts, order history, and customer support — similar to stock trading platforms.

2.3 Advanced Trading Tools

CEXs offer margin trading, stop-loss orders, futures, staking, and more advanced features that attract professional traders.

2.4 Fiat Integration

Centralized exchanges allow direct fiat-to-crypto transactions using debit cards, bank transfers, or even UPI payments (in India).

This makes it simple for new users to enter the crypto market.

2.5 Customer Support

Unlike decentralized systems, CEX platforms have dedicated support teams to assist users in case of account issues, withdrawals, or verification problems.

3. Disadvantages of Centralized Exchanges

Despite their convenience, centralized exchanges come with some drawbacks.

3.1 Custodial Risk

CEX platforms hold your private keys, meaning you don’t have full control over your crypto assets.

As the saying goes — “Not your keys, not your coins.”

3.2 Hacking and Security Risks

Since CEXs store user funds in centralized servers, they are frequent targets for hackers.

Examples:

- The Mt. Gox hack (2014) where users lost 850,000 BTC.

- The FTX collapse (2022) which showed how mismanagement could devastate investors.

3.3 KYC/AML Requirements

Centralized exchanges require users to complete Know Your Customer (KYC) verification, meaning you must share your identity documents.

While this ensures legal compliance, it reduces anonymity.

3.4 Withdrawal Restrictions

Exchanges can freeze accounts, delay withdrawals, or comply with government requests, limiting user freedom.

4. What Is a Decentralized Exchange (DEX)?

A Decentralized Exchange (DEX) operates without a central authority.

Instead of relying on an organization to hold funds and match orders, DEXs use smart contracts — automated programs on the blockchain — to enable peer-to-peer (P2P) trading.

Simply put, users trade directly with one another using their wallets, without intermediaries.

4.1 How a DEX Works

- Users connect their crypto wallets (like MetaMask or Trust Wallet) to the DEX.

- They swap tokens directly using liquidity pools instead of order books.

- Smart contracts automatically execute trades when both parties agree on terms.

- Funds remain in the user’s control throughout the transaction.

4.2 Examples of Popular Decentralized Exchanges

- Uniswap (Ethereum-based) – Pioneer of Automated Market Maker (AMM) model.

- PancakeSwap (Binance Smart Chain) – Known for low fees and meme tokens.

- SushiSwap – Offers additional features like staking and farming.

- Curve Finance – Optimized for stablecoin trading.

- dYdX – A decentralized derivatives trading platform.

5. Advantages of Decentralized Exchanges

DEXs have gained massive popularity among crypto enthusiasts who value privacy, control, and transparency.

5.1 Full Ownership of Funds

On a DEX, you control your private keys and never have to trust a third party with your assets.

Your funds remain in your wallet until the trade is executed.

5.2 Enhanced Privacy

Most DEXs do not require KYC.

You can trade anonymously using just your crypto wallet.

5.3 Transparency

All transactions are recorded on the blockchain, meaning anyone can verify trades — no manipulation or hidden fees.

5.4 Accessibility

Anyone with an internet connection and a crypto wallet can use a DEX, regardless of their country or banking access.

5.5 Lower Risk of Hacks

Because funds aren’t stored on centralized servers, there’s no single point of failure, making DEXs more resilient to attacks.

6. Disadvantages of Decentralized Exchanges

Despite their independence, DEXs also face several challenges.

6.1 Low Liquidity

Compared to centralized platforms, DEXs usually have lower trading volumes, leading to slower transactions and higher slippage.

6.2 Complex User Experience

DEX platforms are less intuitive for beginners.

Users need to understand wallet connections, gas fees, and blockchain networks.

6.3 Smart Contract Risks

If the DEX’s smart contract has a vulnerability, hackers can exploit it and steal funds — even though the platform itself is decentralized.

6.4 Limited Fiat Integration

DEXs typically support only crypto-to-crypto trading.

You cannot buy Bitcoin with fiat directly on most DEXs.

6.5 Transaction Fees

Trading on blockchain networks like Ethereum can involve high gas fees, especially during peak network activity.

7. Differences Between CEX and DEX

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Control of Funds | Exchange holds your funds | User retains full control |

| KYC/AML | Required | Usually not required |

| Privacy | Limited | High |

| Liquidity | High | Low to medium |

| Speed | Fast (off-chain) | Slower (on-chain) |

| Security | Can be hacked | Smart contract risk |

| Regulation | Regulated | Mostly unregulated |

| Ease of Use | Beginner-friendly | Technical knowledge needed |

| Fiat Support | Yes | No (mostly) |

| Examples | Binance, Coinbase | Uniswap, PancakeSwap |

8. The Future of Crypto Exchanges: CEX + DEX Hybrid Models

As the crypto industry evolves, we are witnessing the rise of hybrid exchanges that combine the benefits of both CEX and DEX.

These platforms aim to offer:

- CEX-like liquidity and performance

- DEX-like transparency and self-custody

Examples of Hybrid Exchanges

- Binance DEX – A decentralized version built on Binance Chain.

- IDEX – Combines order book trading with non-custodial asset management.

- dYdX v4 – Moving towards full decentralization with high-performance order books.

Such systems could represent the next generation of crypto trading — balancing user freedom and reliability.

9. Which Exchange Type Is Right for You?

Choosing between a CEX and DEX depends on your goals, experience, and priorities.

9.1 Choose a CEX If You:

- Are a beginner looking for an easy interface.

- Want fiat integration for quick deposits and withdrawals.

- Prefer high liquidity and fast trade execution.

- Don’t mind sharing personal details (KYC).

9.2 Choose a DEX If You:

- Value privacy and autonomy over convenience.

- Want full control of your assets.

- Are experienced with blockchain wallets and DeFi.

- Believe in the decentralization ethos of crypto.

10. Security Tips for Both CEX and DEX Users

Whether you use a centralized or decentralized platform, following security best practices is essential:

For CEX Users

- Use 2FA (Two-Factor Authentication).

- Avoid keeping large amounts of crypto on exchanges.

- Withdraw funds to a hardware wallet for long-term storage.

- Be cautious of phishing links or fake exchange apps.

For DEX Users

- Verify smart contracts before trading.

- Use reputable wallets like MetaMask or Ledger.

- Keep your private keys and seed phrases offline.

- Avoid interacting with unknown tokens or links.

11. Regulatory Landscape

CEX Regulation

Centralized exchanges must comply with financial authorities and follow KYC/AML laws.

This brings legitimacy but also reduces anonymity.

DEX Regulation

Decentralized exchanges are harder to regulate since they operate on open-source code.

However, some governments are exploring frameworks to monitor DeFi protocols in the future.

12. The Bigger Picture Freedom vs Convenience

The CEX vs DEX debate is more than just a technical comparison; it reflects a philosophical divide in the crypto community:

- CEX = Trust in institutions

- DEX = Trust in code

CEXs prioritize ease of use, liquidity, and regulation, while DEXs empower users with self-sovereignty and transparency.

As blockchain technology advances, both will likely coexist, serving different needs and user groups.

Conclusion

Centralized Exchanges and Decentralized Exchanges each play a vital role in the crypto ecosystem.

CEXs make crypto trading accessible, fast, and beginner-friendly, while DEXs uphold the core principle of decentralization giving users full control of their assets. The future of trading might blend both worlds secure, transparent, and user-centric platforms that redefine how we exchange digital value.

%u

I could not refrain from commenting. Exceptionally well written!https://www.bestattungshaus-pflugbeil.de/count.php?url=//ste-b2b.agency

Feel free to surf to my web site :: e-commerce solutions meaning 2026/2025

%u

Thanks for your marvelous posting! I seriously enjoyed reading it, you happen to be a great author. I will make sure to bookmark your blog and will often come back very soon. I want to encourage one to continue your great posts, have a nice day!http://L.V.Eli.Ne.S.Swxzu@Hu.Feng.Ku.Angn..Ub..Xn–.Xn–.U.K37@cgi.members.interq.or.jp/ox/shogo/ONEE/g_book/g_book.cgi

Also visit my blog :: b2b marketing methods to advertise 2026/2025

%u

Hey there! I’m at work browsing your blog from my new iphone! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the outstanding work!https://www.dewittbank.com/disclaimer?url=aHR0cHM6Ly9handhLnJ1L2JpdHJpeC9yZWRpcmVjdC5waHA/Z290bz1odHRwcyUzQSUyRiUyRnN0ZS1iMmIuYWdlbmN5

Also visit my site … how do backlinks help seo discovery